We get your employees paid while providing online access to

paystubs, tax reports & payroll tax filings.

When it comes to Accountant solutions, we have a variety of options that benefit

both your company and your contractor.

Managing your business finances effectively is crucial for long-term

success. Whether you’re a startup, a small business.

Whether you’re a startup, a small business, or an established company, hiring a skilled accountant can help you maintain accurate records, ensure compliance, and optimize your financial strategy.

Efficiently manage vendor invoices, payments, and financial records to maintain cash flow stability. We handle invoice processing, reconciliations, and vendor communication to ensure smooth financial operations.

Handle customer payments, verify transactions, and keep records updated for financial transparency. Our team manages invoicing, debt collection, and cash application to optimize cash flow in small orginasations.

Ensure accurate financial records with comprehensive bookkeeping, customized reports, and account reconciliation. Our services include general ledger maintenance, trial balance preparation and financial report generation.

Manage payroll processing, tax calculations, employee compensation, and compliance seamlessly. We handle payroll tax filings, benefits administration, and direct deposit processing for hassle-free payroll management.

Receive detailed reports on balance sheets, cash flow, profit & loss, and other financial statements for strategic decision-making. Our experts provide real-time financial insights and customized financial statements.

From business registration to financial strategy planning, our experts help you set up and optimize your company’s growth. We assist with entity selection, compliance management, and thier business valuation.

Stay ahead of tax regulations with expert advisory on tax codes, deductions, and legal compliance. We offer tax filing, audit support, and financial forecasting to ensure you stay compliant with all tax regulations.

Whether you plan to build a limited company or require help in the registration of office addresses, get expert accounting insights from our resources. Save time involved in information gathering and analysis of data.

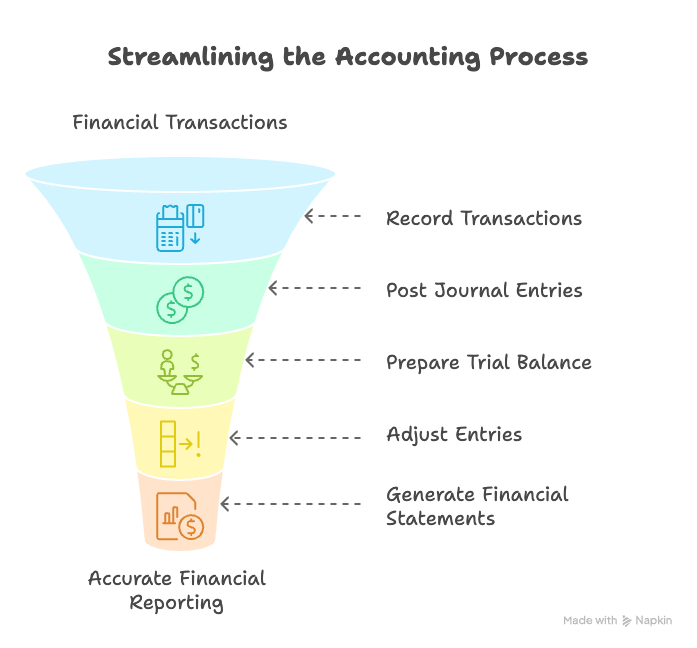

Fulfil All of Your Accounting Needs, From Transactions to Closure

Record financial transactions such as sales, purchases, expenses, and receipts.Ensure that every transaction has proper documentation, such as invoices and receipts.

Record transactions in the journal using a double-entry accounting system.Post journal entries to the general ledger, categorizing them into accounts.

Prepare a trial balance by listing all account balances to check for accuracy.Identify and correct errors using an accounting worksheet.

Make necessary adjustments for accrued expenses, prepaid expenses, depreciation, and other items.Ensure financial records accurately reflect the company’s financial position.

Prepare financial statements, including the income statement, balance sheet, and cash flow statement.Use these statements to analyze the company’s financial performance.

Close temporary accounts (revenues, expenses, dividends) to retained earnings. Prepare the accounting system for the next financial period.

"BDGAGSS has been an invaluable partner in managing our finances. Their expertise in tax planning and bookkeeping has saved us both time and money. Highly recommended!"

"I was struggling with my business taxes until I found BDGAGSS. Their team guided me through deductions and ensured I maximized my returns. Fantastic service!"

"BDGAGSS has been handling our accounts for years, and they never disappoint. Their financial advice has helped our business grow significantly."

We save you from all that boring paperwork! From global hiring, to instant payments, and taxes, we’ve got your back.